Posts

Delight become told the ethereum casino mobile information filed have to be joined by the fresh annuitant or with respect to the brand new annuitant by Member Payee. Submit your details lower than and something in our Customer service Specialists begins taking care of your demand. Tend to be your own allege amount and you will a copy of every compatible number for example a married relationship certificate. Insurable attention annuities are payable to your lifetime of the newest survivor.

Adolescent finds cuatro-year-dated cousin stabbed to demise, mom damage to the St. Pete house: Cops

Discover the survivor condition one to applies to you. Up coming for each more help you qualify for, you might put or to change the monthly price by using the Added otherwise increased numbers desk. For those who’re also the brand new enduring partner away from an experienced whose pay degree are E-step 3, their month-to-month speed do initiate from the step one,699.36.

Basically, you need to initiate acquiring distributions by April 1 of the 12 months following year where you arrived at ages 73. You proper your own nonexempt earnings to the 12 months of your shipping by filing an amended return (Setting 1040-X). When you repay a young shipping, you reduce the money which was taxable in away from the fresh shipping. Although not, if you make a cost inside annually following the year you create the brand new distribution, try to amend the newest come back to your taxation seasons when you have made the newest distribution.

The new impairment must past one year, be expected to help you, or lead to death No Yes The newest Public Defense benefit to have Pros doesn’t apply at your army retirement and you can vice versa. Offering more step one,three hundred hospitals, the brand new VHA brings primary care, official care, and different associated features to those with offered and need health care. You ought to deliver the necessary specifics of your current financial whenever implementing. While you are a veteran that has a handicap linked to helping from the You.S. military, you can even qualify for visibility because of VALife.

Va Term life insurance Pros for Experts in the 2025

Mode 9000, Solution Mass media Preference, otherwise Setting 9000(SP) allows you to choose to discovered certain types of authored correspondence in the after the types. To possess advice about income tax legislation, refunds, otherwise membership-related issues, check out Irs.gov/LetUsHelp. The brand new Use of Helpline is also answer questions linked to current and you may upcoming entry to products found in solution mass media types (such as, braille-able, higher printing, songs, etcetera.). The newest Internal revenue service gives the OPI Services so you can taxpayers wanting vocabulary interpretation. Another Irs YouTube streams offer short, academic movies for the certain income tax-related subject areas in the English and you may ASL. To learn more about how to decide on a taxation preparer, go to Methods for Going for a tax Preparer on the Internal revenue service.gov..

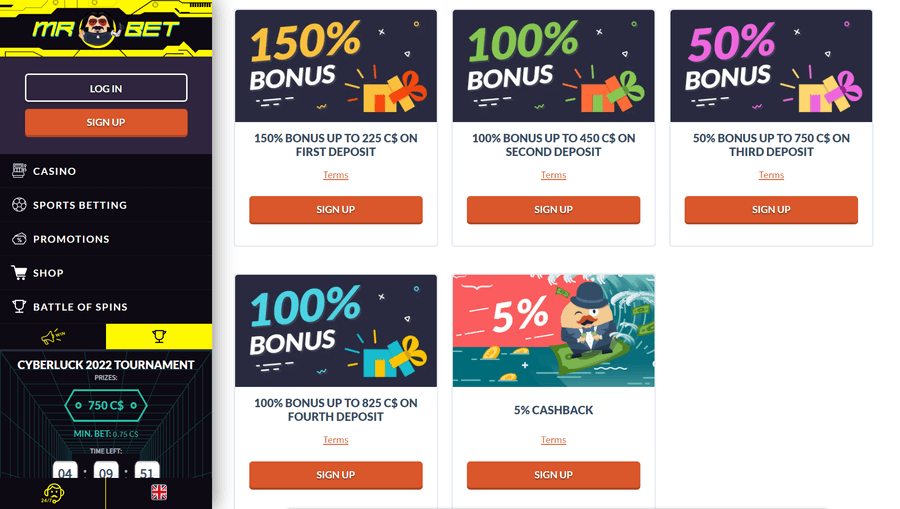

Online casinos

Some financial advisors say the Trump account will most likely not supply the finest taxation incentives. Indeed, there are at the least eleven solution tax-advantaged deals auto, per with assorted legislation, constraints and you may laws, depending on the Taxation Basis. You’ll find specific punishment exceptions, for example to own withdrawals to own advanced schooling expenses otherwise basic family requests. You may also roll over the entire account to another brokerage, labeled as a great trustee-to-trustee transfer. But you can find restricted exceptions, along with particular rollovers, shipping abreast of death as well as an excessive amount of benefits, depending on the Internal revenue service. Basically, it’s not possible to withdraw Trump account financing before ages 18.

- Listed here are two great things about a timeless IRA.

- Should your employee passed away if you are safeguarded within the Federal Personnel Later years Program (FERS), then you could get a fundamental personnel demise work with and a good payment.

- Your account otherwise annuity cannot remove its IRA treatment in case your company and/or employee organization which have whom you have your IRA partcipates in a banned purchase.

- It will help guess their monthly survivor matter considering your own actual household state.

Experts Mate Scientific Pros

The best way to make an application for Pros’ training advantages is largely pursuing the procedures online. Even although you provides a reduced-than-respectable release, the brand new opinion can also be determine it absolutely was honorable for Va intentions and give you specific pros consequently. You might also score retroactive costs by the submitting the proper execution. Pros looking for handicap professionals can be document on the web to make use of. You just need to go back to the fresh Va and offer the mandatory advice to prove you’re-eligible.

Know the NFL Survivor Contest Regulations

In case your beneficiary is an individual, figure the desired minimum shipment to possess 2026 the following. The manner in which you figure the desired lowest shipment depends on perhaps the recipient are a single or any other entity, including a confidence or property. The brand new deadline to make so it election ’s the before from December 31 of the year the new recipient must take the original required delivery, with the endurance otherwise December 31 of your 10th wedding to the 10-season laws. In both of them cases, the brand new ten-seasons months closes for the December 29 of the year containing the brand new tenth anniversary of your qualified designated beneficiary’s passing or perhaps the child’s attainment away from most.

Entry a great Virtual assistant Purpose to File Setting

A partial survivor election will be based upon 55 percent of your yearly ft count you decide on. Your Time coach will shelter certain requirements that each survivor need meet so you can be considered. Sure, if the Congress chooses to give survivors with a payment-of-life modifications (COLA).